Project 2025: A Dangerous Plan That Must Be Stopped

Dear Friend,

This is Congressman Steve Cohen, here to tell you about a resolution I recently requested to cosponsor condemning Project 2025. Read on for more information and click below to sign up for my weekly eNewsletter.

Project 2025: A Dangerous Plan That Must Be Stopped

Project 2025 is a blueprint for disaster, and that’s why I’m cosponsoring H.Res. 1386 to condemn it. Originally crafted by one of the wealthiest conservative activist organizations in the country, the plan includes drastic cuts to important federal agencies and services, tax breaks for billion-dollar corporations and the wealthiest Americans, and it would add trillions to the national deficit. It’s a return to the failed “trickle-down” economics of years past—a system that benefits the rich while burdening the middle class and working families.

Here’s a quick overview of just some of the things that Project 2025 calls for:

- A Corporate Tax Giveaway — It slashes the corporate tax rate from an already low 21% to just 18%, a handout for rich corporations that could cost around $300 billion. Before the Trump Administration's Tax Plan of 2017, the corporate rate was 35%.

- Higher Taxes for the Middle Class — By changing marginal tax rates and removing deductions, Project 2025 reduces taxes for the wealthiest earners while increasing them on the middle class.

- Tax Breaks for the Wealthy — It reduces the capital gains tax rate from 20% to 15%, primarily benefiting high earners and leaving working families with a heavier burden.

- No Support for Families — There is no plan to continue or expand the Child Tax Credit, a vital support for millions of American families.

- Undermining the Internal Revenue Service (IRS) — The plan seeks to cut $2.2 billion from the IRS, decimating efforts to ensure wealthy individuals and corporations pay their taxes, and making it harder to hold wealthy tax cheats accountable.

- Weakening the Department of Justice (DOJ) — Cuts the DOJ's Civil Rights Division by $35 million, greatly harming their ability to protect Americans' civil rights and promote equity nationwide. Also calls for cuts to DOJ's Office of Legal Counsel, and prohibits DOJ from pursuing legal action against states that are eliminating women's rights.

- Weakening the Department of Labor (DOL) — Would prohibit funding to implement or enforce the DOL's final rule that ensures more workers are eligible for overtime pay, re-imposing the Trump Administration's threshold for eligibility for overtime pay and harming middle-class Americans.

- Eliminating the Department of Education (ED) — The plan calls for the total elimination of the ED, as well as deep cuts to Title I and public education, cancelling all of President Biden’s student loan forgiveness programs, and the elimination of federal student aid.

- Eroding Civil Service Protections — Project 2025 would reduce civil service protections, allowing for widespread presidential appointments throughout key agencies like the DOJ, IRS, FCC, FDA, DEA, FBI and EPA, potentially undermining impartiality and leading to politically motivated decisions that could negatively impact everyday Americans.

- Further Restrictions on Abortion Services — It prohibits funding for women to travel to another state to access abortion services and would cut Medicaid funding to states that require health insurance plans to offer coverage of abortion services.

- Handcuffing Congress — It requires a supermajority in Congress to pass any new tax increases, making it nearly impossible to reverse these disastrous policies.

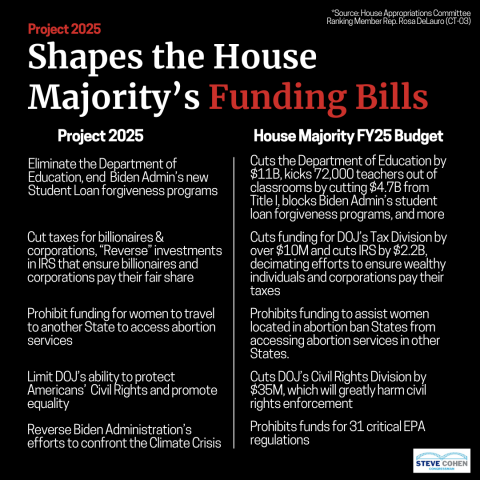

Despite attempts by some conservatives to distance themselves, Project 2025 is already here, shaping legislation being considered by this Congress. Information compiled by the House Appropriations Committee Ranking Member Rep. Rosa DeLauro (CT-03) shows the direct influence that Project 2025 is having on this year’s appropriations bills as Congress continues budget negotiations for Fiscal Year (FY) 2025. Check out a side-by-side comparison below for just a sample of how Project 2025 is manifested in the House Majority’s proposed FY25 budget bills.

I’ve worked against these sorts of backwards policies for my entire career. I’m the sponsor of bills like the Billionaire Minimum Income Tax Act to ensure the mega-wealthy pay their fair share, I’ve strongly supported expanding the Child Tax Credit and making it permanent, I’ve fought against racial discrimination in housing, lending, and everywhere else, I’ve always voted to protect women's right to choice and other civil liberties.

I’m going to continue doing all I can to stop Project 2025 and its harmful policies from becoming law—in the FY 2025 budget or anywhere else. We need a tax system that’s fair and a budget that reflects our values, not one that caters to billionaires and leaves hardworking people behind.

Thank you for taking the time to read this important update. If you have any questions or need more information, please don’t hesitate to contact my Memphis office at 901-544-4131, or my Washington, DC office at 202-225-3265. To stay informed about my work as it happens, click here to sign up for my weekly eNewsletter and click below to follow me on social media.

As always, I remain,

Most sincerely,

Steve Cohen

Member of Congress